By continuing to use our website, you are accepting our use of cookies. The cookies we use are "analytical" cookies. They allow us to recognise and count the number of visitors and to see how visitors move around the site when they are using it. To find out more or to change your cookie preferences, please refer to our cookies policy.

ACCEPT

© Societe Generale 2025

Cookies Policy

Legal Information

Disclaimer

Contact

Accesibility: not compliant

20

24

SOCIETE

GENERALE

ESG SURVEY

About the respondents

CONDUCTED IN THE FOURTH QUARTER OF 2024, THE SURVEY GATHERED INSIGHTS FROM 147 INSTITUTIONAL INVESTORS* IN THE CREDIT MARKET, FOCUSING ON ESG TRENDS IN FOUR MAIN AREAS:

*The majority of respondents are located in EMEA (73%) and mainly represent institutions headquartered in EMEA (69%). Their roles are diverse dominated by ESG team representatives:

ESG Team 21%

Syndication 16%

PM 14%

Origination 13%

Coverage 11%

Analyst 9%

Sales & Trading 6%

Treasury 5%

Other 3%

Strategy / Management 1%

01

MOTIVES

TO

ESG CONSIDERATION

The most designated factor towards increased ESG investments differs depending on the institution type surveyed as illustrated below:

- End investors demand for ESG among asset managers

- Business opportunities and ESG risk mitigation among banks

- ESG risk mitigation among insurers

- Fiduciary duty and regulations equally among pension funds

BANKS N24

INSURERS N3

ASSET MANAGERS N44

PENSION FUNDS N7

ESG is viewed in majority as a neutral driver for higher financial performance except for banks considering it as positive driver. A few percent of respondents within asset managers and pension funds consider ESG as a barrier for higher financial performance.

BANKS N24

INSURERS N3

ASSET MANAGERS N44

PENSION FUNDS N7

02

APPROACHES

TO

ESG CONSIDERATION

Motives for ESG Consideration

The motives for ESG investment vary by institution type. Among surveyed asset managers, 80% identified end investor demand as the primary driver, while surveyed banks (83%) cited ESG risk mitigation as a significant factor. Interestingly, 43% of surveyed asset managers view ESG as neutral for financial performance, whereas 42% of surveyed banks see it as a positive driver.

Approaches to ESG Consideration

Key challenges include the risk of greenwashing and lack of standardized data, with 58% and 64% of respondents highlighting these concerns, respectively. Institutions headquartered in AMER display a lower rate of adoption of ESG policies, ESG-related exclusion criteria or ESG capital deployment targets.

Integration for ESG Consideration

Engagement and dialogue emerged as the most common ESG investment approach (65%), surpassing both negative (56%) and positive screenings (43%). Due to inconsistencies in ESG data, 54% of respondents use proprietary ratings to classify ESG investments.

Market Expectations and Outlook

Surveyed Investors in both the Americas and EMEA regions showed a strong interest in Green, Social, and Sustainability products, particularly transition bonds (55%) and social bonds (41%). Notably, more than 81% of respondents plan to increase their ESG allocations, with a preference for low carbon-intensive issuers over ESG-labeled products.

108 EMEA

23 AMER

16 APAC

Investment Strategy

Insurers are most impacted by end investors demands for increased ESG focus into their investment strategies (67%) than other institutions but globally the consideration of this factor doesn’t impact directly investment strategies.

Does your institution have a formal ESG Policy applicable to its investing activities?

Are end investor demands for increased ESG focus changing your investment strategy? N61

Exclusion based investing is a very common sustainable investment approach except for institutions headquartered in AMER where 47% of institutions have no ESG-related exclusion criteria.

Sectorial exclusions remain the most implemented exclusion approach in EMEA and APAC. Coal and tobacco are the two sectors being excluded largely. Oil & gas upstream sectors are negatively screened by a substantial proportion of institutions headquartered in EMEA and to a lesser extent regarding oil & gas mid and downstream sectors.

In order to implement these sectorial exclusions, a large majority of respondents (74%) perform internal analysis to assess the applicability of their exclusion policies.

Do you have any

ESG firm-wide exclusion? N141

Are there any sectors that you are excluded from investing on ESG grounds? N120

Respondents Role n147

Respondents location n147

Which ESG products does your institution have experience investing in? N123

What is driving you towards more ESG investment? n78

What is your view of ESG as a driver for higher financial performance? N78

Per institution type and respondent location (according to where the respondent is based).

Per institution type and respondent location (according to where the respondent is based).

Lastly, asset managers are mainly active in the GSSS market as investors in green, social and sustainability linked bonds. Green bonds, green loans and sustainability linked loans are the mainstream products where banks are involved.

The respondent’s location above is based on where they are based. When taking into consideration where their company headquarters is instead, 101 are located in EMEA, 27 in APAC and 19 in AMER.

How do you implement these sectorial exclusions? N142

For asset managers, banks and pension funds, risk of greenwashing and lack of standardized data are the two main challenges and concerns they are facing with regards to ESG investing. Insurers have raised the unattractive pricing of ESG assets as the main challenge.

What are the key challenges and concerns you are facing with regards to ESG investing? N79

BANKS N24

INSURERS N3

ASSET MANAGERS N45

PENSION FUNDS N7

ESG goals and targets

The importance of ESG in the asset management and the insurance industry is demonstrated by the deployment of specific ESG funds responding to the needs of their clients and all stakeholders. Globally, 59% of respondents declare having specific ESG funds to deploy.

Per institution type and respondent location (according to where the respondent is based).

(According to where the respondent headquarter is)

(According to where the respondent headquarter is)

Do you have specific ESG funds to deploy?

Roughly equally distributed, climate funds and green funds are the first two categories in which asset managers deploy their ESG funds. Then, social funds hold the rank 3 for 44% of asset managers and other thematics the rank 4 for 53% of them.

For banks, green funds are ranked systemically as the first category in which ESG funds are deployed followed by social funds in rank 2. Then, climate funds and other thematics are equally distributed in rank 3 and rank 4.

Eventually, all surveyed insurers consider the deployment of ESG funds with the following priority order: green funds, climate funds, social funds and other thematics.

Eventually, all surveyed insurers consider the deployment of ESG funds with the following priority order: green funds, climate funds, social funds and other thematics.

BANKS N2

INSURERS N2

ASSET MANAGERS N34

Do you have specific ESG capital deployment targets?

Globally, one quarter of banks don’t have specific ESG capital deployment targets but 41% intend to deploy such in a near future except banks headquartered in AMER. Banks headquartered in EMEA are the most advanced with 37% having such targets; still the gap with APAC should be filled in the near future.

According to where the respondent headquarter is N83

According to where the respondent headquarter is: N146

03

INTEGRATION

OF

ESG CONSIDERATION

In term of geography, American institutions are slighty less likely to have internal team on this sector.

Organization

Does your institution have a specialised ESG/Sustainable Research team? N147

Does your institution have a specialised ESG/Sustainable Finance Advisory team? n138

ESG investment approaches share common ground across institutions. Engagement & dialogue is the most widely deployed approach, by 65% of investors globally, followed by negative screening (56%), positive screening (46%), impact investing (39%) and thematic investing (33%).

strategy and processes

How ESG considerations are integrated into your internal policies? n147

Do you ascribe any value to ESG-linked features for issuers or transactions? n76

For all respondents but insurers, ESG linked-features for issuers or transactions are largely regarded as an element of the investment decision process, not necessarily assigned with a monetary value. When it is not the case, institutions ensure basic ESG credentials are met as a prerequisite for investment.

The challenge around the completeness and consistency of ESG data from rating agencies and specialized providers make it difficult to rely only on external/rating certification. In this context, most respondents assign a proprietary rating to classify an investment as ESG except pension funds, freed from this assessment.

Do you require an external rating/certification to classify the investment internally as ESG? n140

This trend is confirmed by the highest proportion of institutions relying on external partnership with ESG data providers combined with internal analysis to implement their ESG policies, globally at 52%. Then, a non-negligible proportion of institutions declare not relying at all on data from external sources to implement their ESG policies (e.g. 31% of banks, 33% of insurers, 25% of asset managers).

Do you rely on partnerships with external data providers to implement your ESG policy? n144

04

REGULATORY IMPACTS

ON STRATEGY

AND PRODUCTS OFFERINGS

With regards to the EU Sustainable Finance Disclosure Regulation (SFDR), which classifications are you targeting for your funds? n20

The principal SFDR classification targeted by almost half of asset managers for their funds is Article 8 while around one third target either article 8 or article 9. A very small percentage of respondents are willing to consider none of SFDR funds’ categories.

Globally, 47% of institutions report an alignment of investments with EU taxonomy between 1% and 5%.

50% of asset managers report alignment in this 1% to 5% category while this percentage drops to 17% in the 5% to 15% category. The other ranges of alignment (<1%, between 15% and 30% and >30%) are equally represented. 63% of asset managers plan to increase this percentage.

Do you plan to increase this percentage? n20

What is the percentage of EU taxonomy alignment of your investments? n19

following esma's guidelines on funds names using esg or sustainability related-terms, do you plan to? n19

If concerned by the application of ESMA guidelines on funds’ names, more asset managers plan to adapt funds’ names, rather than adjusting investment’s universe to comply with the rules.

Do you expect EU GBS labelled bonds to trade at a premium vs other Green bonds? n29

By far, the first advantage highlighted by respondents (71%) about the EU Green Bond Standard refers to the common and standardized disclosures for issuers. Then, investors (52%) consider the alignment with the EU Taxonomy as the second advantage, followed by the external reviewer check (26%).

What strong advantages do you see in EU Green Bond Standard (GBS) labelled bonds? n31

Despite clear opinion on the EU GBS advantages, a large majority of investors (69%) don’t expect EU GBS labelled bonds to trade at a premium vs other Green bonds.

05

SUSTAINABLE

FINANCE

Are there any sectors where you would like to see more ESG issuance? n102

Globally but also per region-based location of the respondent, more ESG issuances from the three following sectors are favored: i) Oil & gas, ii) Metals & mining and iii) Industrial. In APAC, there is no big appetite (9%) for more ESG issuance from the Autos sector compared to AMER (50%) and EMEA (33%).

Generally, both AMER and EMEA based investors share the same appetite for more Green, Social and Sustainability (GSS) products favoring in particular transition bonds (55% globally) and social bonds (41% globally). There is a divergence on outcome bonds for which 75% of AMER based investors are keen to see more supply vs 7% for EMEA based investors.

Which type of GSS products would you like to see more supply? n22

06

TRANSITION

FINANCE

How much of your time is dedicated ESG topics? N145

Which products do you cover? N90

Among the population of respondents holding one of the following roles: Analyst, Origination, Portfolio manager, Sales & Trading and Syndication, 58% of respondents are involved in loans capital markets, followed by 38% in bonds markets.

Asset managers are mainly active in the GSSS market as investors in green, social and sustainability linked bonds. Green bonds, green loans and sustainability linked loans are the mainstream products where banks are involved.

Do you have any particular interest in Transition Finance? n141

Banks (80%), asset managers (69%) and pension funds (67%) express the highest interest in transition finance. Insurers tend to be more pragmatic with only 33% of respondents in this category declaring any particular interest in transition finance.

Can you look at a transaction with some of the below issues if a credible transition is in place? n137

There is a consensus among a substantial proportion of institutions to consider the credibility of a transition plan as a driver of a transaction in the case where current ESG issues are observed. Only insurers declare a strict position with 100% of them not being opened to such possibility while for the other institutions, this is less than 30%.

07

OUTLOOK

Do you plan to increase allocations to new ESG products in the next two years? n146

Globally, 81% of respondents plan to increase their allocation to new ESG products in the next years. Among banks, 89% plan to do so while 73% of asset managers will follow the same trend as well as 57% of pension funds. Only a third of insurers declare being in favor of such increase and hedge funds are not at all aligned.

BANKS N2

INSURERS N2

ASSET MANAGERS N31

PENSION FUNDS N4

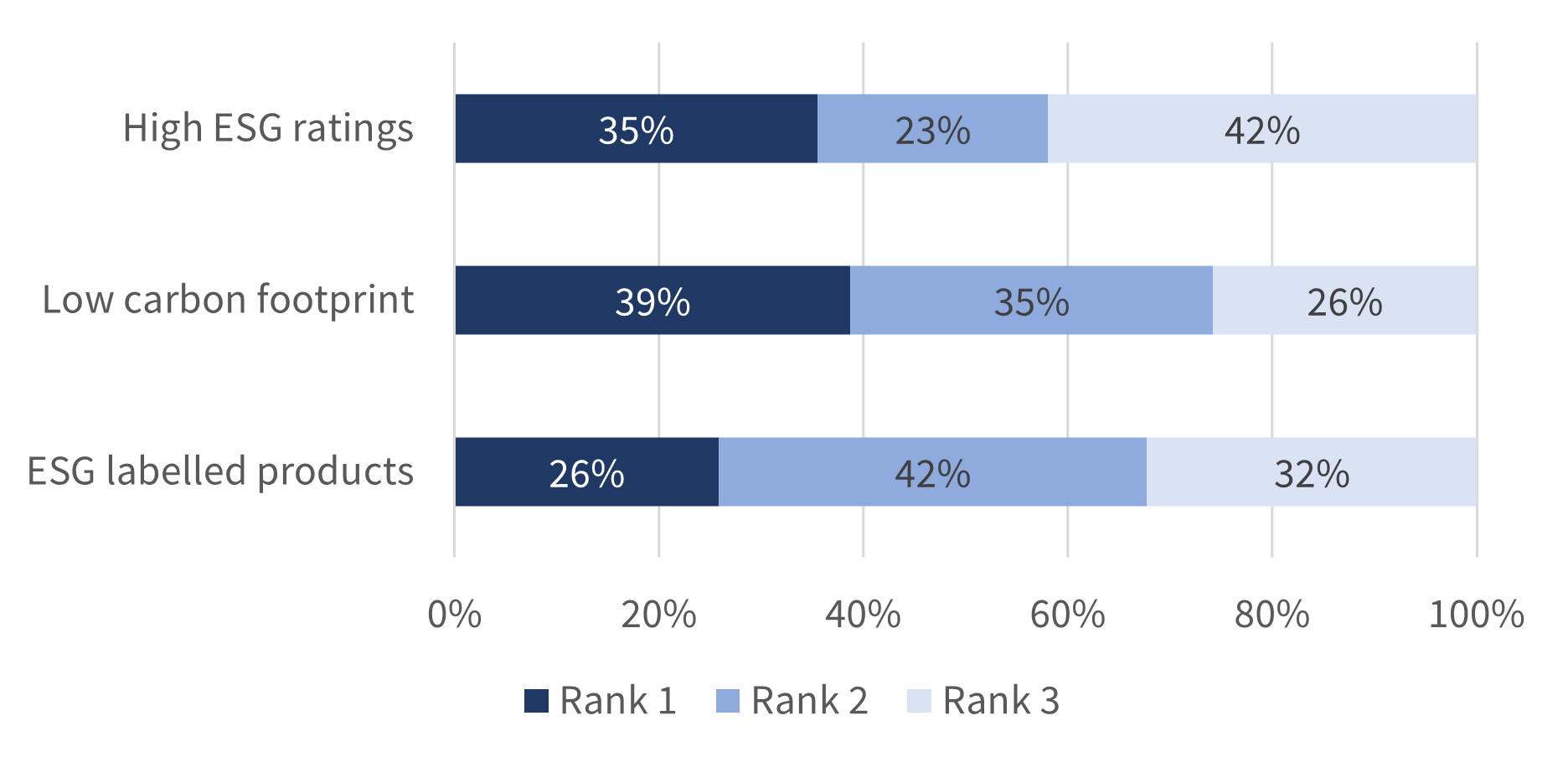

Asset managers and asset owners (insurers and pension funds) tend to favor low carbon-intensive issuers/assets. Asset managers and pension funds then consider ESG labelled products as the second preferred choice before considering high ESG ratings feature.

Banks have an equal preference for ESG labelled products, high ESG ratings and low carbon intensive issuers/assets.The second most preferred one is low carbon footprint, followed by high ESG ratings.

Which issuers/assets will you favour going forward?

Based on previous conducted surveys

Almost all investors now have a formal ESG policy. However, banks were relative laggard compared to non-banks which have been flat since 2021

ESG policy for investment activities is definitely a standard adopted by institutions across all regional headquarters location. AMER is lagging with the smallest percentage of institutions headquartered in this region having such policy (84%).

We are seeing divergent trends between banks, which have flatlined since 2022 in their ESG deployment targets and non-banks, which are seeing significant growth in all geography.

Based on previous conducted surveys

According to the respondents N64

Based on previous conducted surveys

Does your institution have a specialised ESG/Sustainable Finance Advisory team? (by geography)n138

Asset Managers, banks and pension funds have largely made the choice to rely on internal teams dedicated to ESG and sustainability -including Research- to drive their strategy. Insurers are more often equipped with a unique team dedicated to ESG research.

A majority of non-banks investors continue to value ESG-linked transactions. However, we are seeing decrease willingness to pay for those features and an increase in the number of institutions not valuying them at all, particularly in 2024.

Based on previous conducted surveys

Do you have internal incentives to promote esg investments?

Roughly 2/3 of banks continue to have internal incentives (lower RWA or ROE for example). However, we have seen almost no changes since 2022 among all geography.

RESPONDENTS (N)

BANKS

ASSET MANAGERS

5% PENSION FUNDS

2% INSURERS

1% HEDGE FUNDS

147

62%

31%