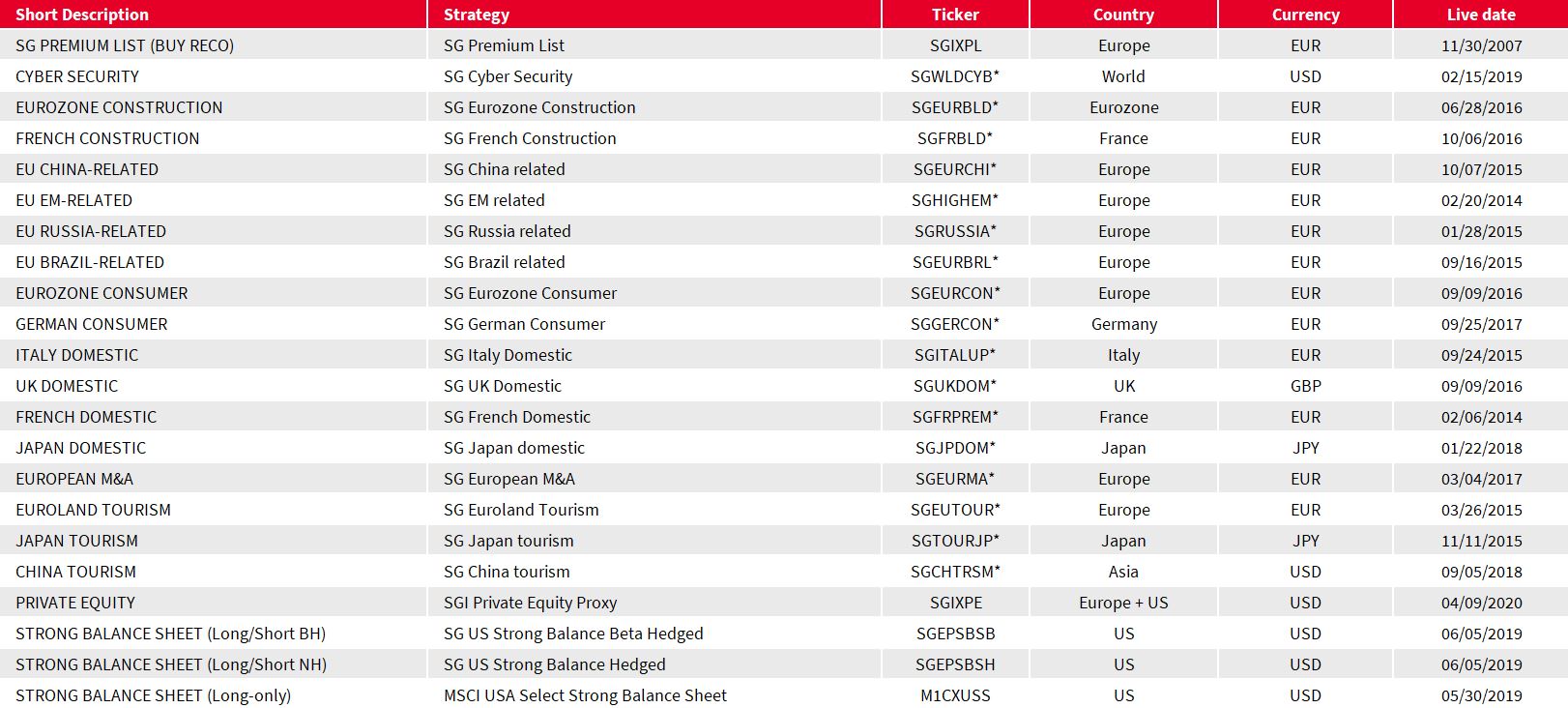

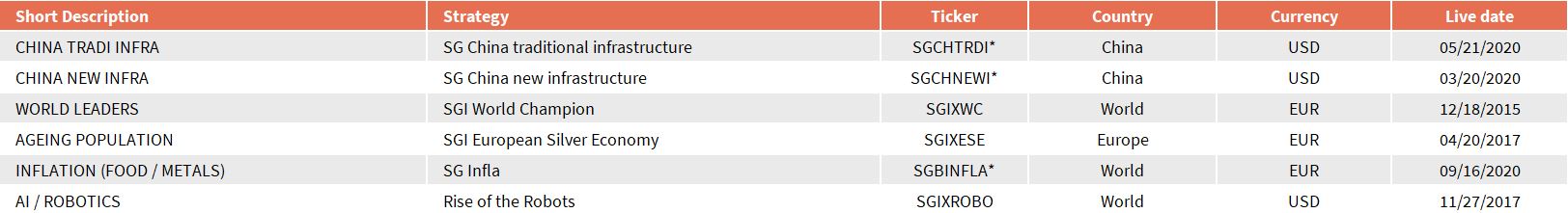

THEMATIC AND QUANT

CASH EQUITY BASKETS

WHAT DO WE OFFER?

Société Générale has developed, thanks to a recognized research team and a strong engineering team, a large range of investment themes that exploit the most popular and innovative thematics of the current market.

Recent years have witnessed a significant increase in interest in such strategies from investors, driven by the advantageous features offered by the systematic strategies through index format: transparent, cost efficient, liquid and flexible.

Société Générale offers off-the-shelf products based on Thematics Ideas developed by SG Research, as well as execution services that allow our clients to customise SG strategies and/or develop their own.

aCCESS

LIQUIDITY

TRANSPARENCY

COST EFFICIENCY

FLEXIBILITY

Get access to the broad SG services:

Daily liquidity using the most liquid underlyings

Rules based with a third party calculation agent

The simplification of the investment process thanks to systematic algorithms and SG experience (trading, structuration and risk management) allows to exhibit innovative solutions at lower fees.

Each Strategy is fully customizable to precisely match clients’ objectives and constraints through a tailor made solution (ESG scores, Exclusions, Geographical focus…)

Daily publication on Bloomberg

Full disclosure on cost and fees

Detailed reporting on performance and positioning

SG Research ideas

SG Index expertise

SG execution capabilities

SG risk management tools

who are our clients?

ASSET MANAGERS

PENSION FUNDS

INSURERS

HEDGE funds

ETF PROVIDERS

PRIVATE WEALTH

MANAGERS

private banks

key features of the platform

ESG

ARTIFICIAL

INTELLIGENCE

CURRENT

AFFAIRS

FACTORS

Thematics/

Megatrend

MARKET

SEGMENT

Address your environmental, social and governance priorities

The next economic revolution

Benefit

from tactical

themes

Investment approach using specific drivers of returns (Quality, Value, Momentum…)

Long term trend

&

global transformation in the market

Targeting

a specific market?

Find out More

Find out More

Find out More

Find out More

Find out More

Find out More

WHY SOCIETE GENERALE?

Société Générale helps clients to exploit the most trendy and innovative thematics of the current market, leveraging on the strong expertise and experience of various teams.

A LEADING RESEARCH

The Research Team (Equity Quant and Equity Strategy), one of the best and well-resourced in the market, offering clients access to the highest quality investment ideas globally.

The Index Platform Team has a long history in index design, calculation and administration with a robust governance and a strong platform infrastructure, providing detailed client reporting and web based interface.

A ROBUST INDEX PLATFORM

The SG trading has a global coverage and a strong execution capacity thanks to an experienced team of experts backed by deep market knowledge, analytics and insights.

AN EXPERIENCED TRADING TEAM

YouTrack is a web platform, part of SG Markets, offering an efficient and transparent solution for investors to manage discretionary strategies or to monitor systematic one. Clients have access to relevant information, reports and analytics (like liquidity with “Basket Scan”).

A RECOGNIZED DIGITAL TOOL

in Equity Quant Analysis

for the past 11 years

#1

Bios EUR in total AuM

54

Live

Indices

1800+

Electronic execution platforms

30+

Markets & execution venues available globally (largest markets & memberships in the industry)

130+

Best Proprietary

Index Provider

2017 & 2018 & 2019

how to trade?

© Societe Generale 2022

YouTrack is a web platform, part of SG Markets, offering an efficient and transparent solution for investors to manage discretionary strategies.

It enables the Advisor to:

Access relevant information and reports on their strategy or related products.

Manage, monitor and execute their investment strategies with ease.

Benefit from a streamlined and simplified online platform using SG capacity and expertise in structuring and trading.

pre trade tools - sg markets analytics

SG Markets Analytics is a dedicated range of tools allowing you to screen instruments, apply models, price strategies and optimise portfolios. Through the platform, Societe Generale provides full transparency on pricing and implicit levels via historical and live data.

ANALYTICs

BASKET SCAN

Basket Scan provides in-depth data around the execution of equity underlyings (single names, custom baskets or indices.

It analyses a portfolio based on different parameters: capitalization, factors, sectors and indices.

It shows which stocks have potential liquidity issues, allowing you to contemplate alternative strategies on those particular names.

The tool gives a precise timing of a basket execution, determined by the percentage of trading volume you would like to participate in.

Click HERE TO

ACCESS THE TOOL

Daily liquidity using the most liquid underlyings

access

LIQUIDITY

Investability

Each Strategy is fully investable via:

Certificates

Notes

Swaps

Funds

Tools

available

29

APIs

available

26

post trade tools - youtrack

Info

+

Societe Generale’s delta one solutions – Certificate, Note, Swap – provide a direct exposure to the performance of the chosen thematic and quant equity cash strategy with a full flexibility in term of characteristics:

Funded or unfunded structures available, open or closed ended maturities, leverage, short exposure, currency, FX hedging, Collateral.

SG also offers a range of tools through the SG Markets platform allowing clients to perform pre- and post-trade services on a strategy.

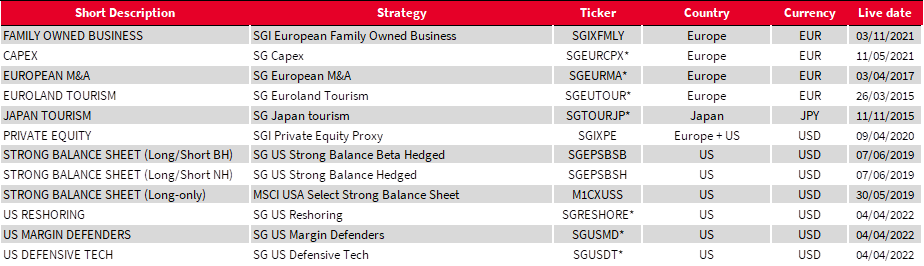

STRONG BALANCE SHEET

PRIVATE EQUITY

Rationale

SOLUTION

WRAPPER AVAILABLE

US small caps have seen the greatest rise in leverage over the past decade. Despite record low interest rate, interest cover is poor. The stocks with stronger balance sheets have been outperforming those with weaker ones.

Select the top 250 US small cap universe companies based on the strength of their balance sheets using the Merton Distance to Default methodology.

Note, Certificate, Swap

Rationale

Providing higher and less volatile historical returns than equity markets, Private Equity has become a very attractive asset class offering new diversification perspectives compared to traditional listed asset classes. But the illiquidity as well as the high investment minimum and cost structure might refrain investors.

Provide a performing, liquid and transparent strategy replicating an illiquid investment.

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Available long only () and hedged by shorting Russell 2000 (beta hedged: ; nominal hedged: ).

Based on the SG Equity Quant Research papers (#1 in Extel survey for past 11 years).

Using Private Equity funds methods in a systematic way, the strategy selects at least 100 stocks (80% US, 20% Europe) most closely resemble the positive characteristics of the companies found in buyout fund portfolios (small cap and profitable with low valuation). Ticker:

X

MARKET SEGMENT

Targeting a specific market?

*The strategy referred to herein remains subject to approval by Société Générale’s internal committee. The strategy may be amended from time to time (economic terms and conditions or any other elements as the case may be) and should be considered as final only after the formal validation by the internal committee.

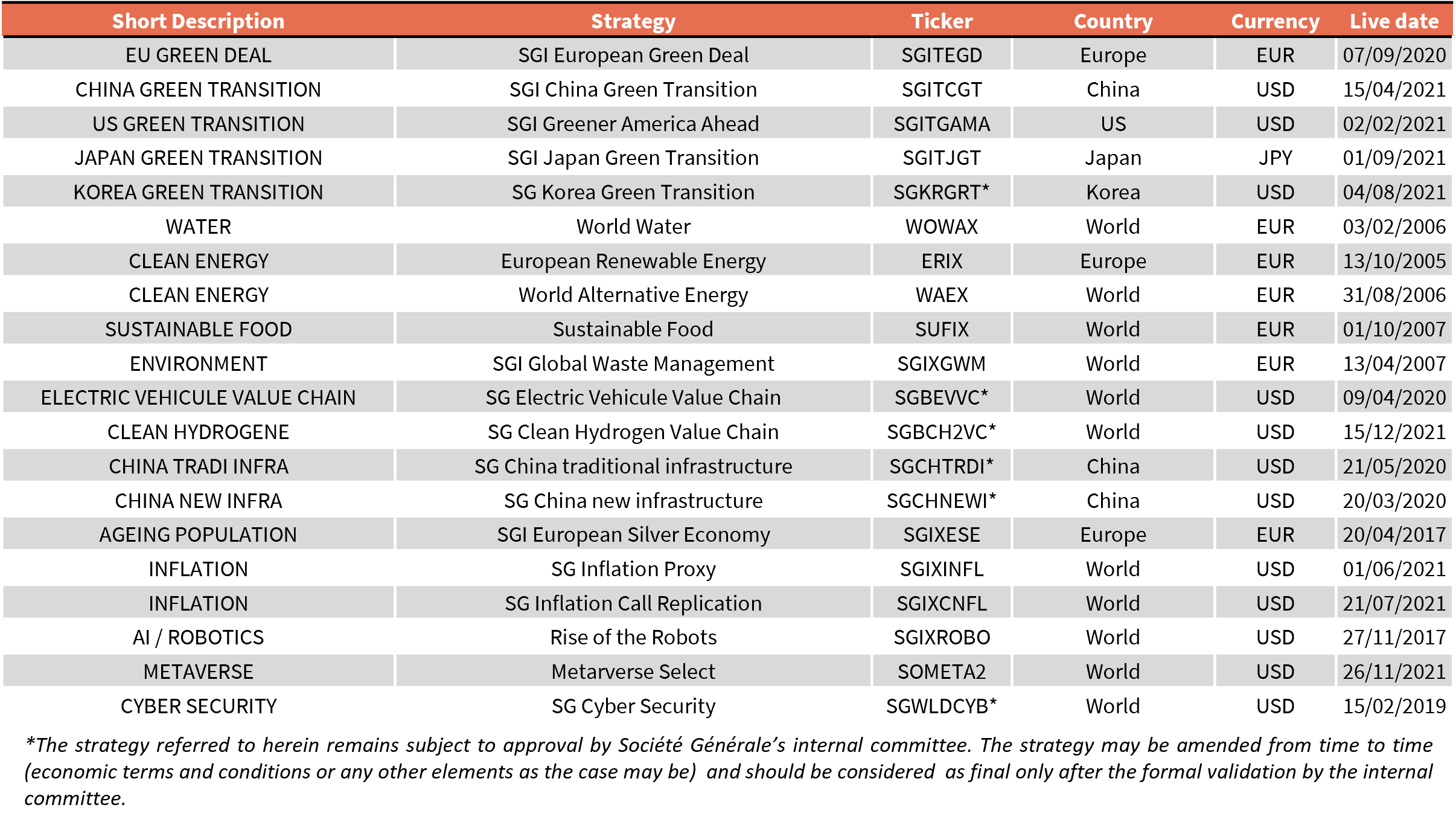

Thematics/Megatrend

Long term trend &

global transformation in the market

X

Rationale

In order to offer its clients a best-in-class exposure to Artificial Intelligence and Robotics themes, SG Research has partnered in exclusivity with Martin Ford, author of the NYTimes Bestseller, “Rise of the Robots”, winner of the 2015 Financial Times/McKinsey Business Book of the Year Award.

The SGI Robot Index is composed of 150 small, mid and large stocks that could benefit from the development of the Robotics & Artificial Intelligence.

Systematic selection from the defined universe of 150 stocks (quarterly rebalancing), based on the R&D to sales, Return on Invested Capital and Sales growth. An ADV (average daily volume) threshold is also included in order to maintain high liquidity.

Note, Certificate, Swap & ETF (, AuM: 378M$)

SOLUTION

WRAPPER AVAILABLE

RISE OF THE ROBOTS

Inflation

Rationale

The inflation market has never been so low. ECB, other central banks and governments have taken many measures to boost the economy and inflation. With negative bond yields, an increase in inflation in the nearest future could be a threat to investor’s equity portfolios’ value.

The SG Inflation basket of stocks is an equally weighted basket of stocks within food and metals sub-baskets (60% food stocks & 40% metals stocks). The basket allows for a less expensive way to hedge inflation risk with equities for the investors wary of inflation shocks that may lay ahead as the economic recovery continues.

*The strategy referred to herein remains subject to approval by Société Générale’s internal committee. The strategy may be amended from time to time (economic terms and conditions or any other elements as the case may be) and should be considered as final only after the formal validation by the internal committee.

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Ticker: *

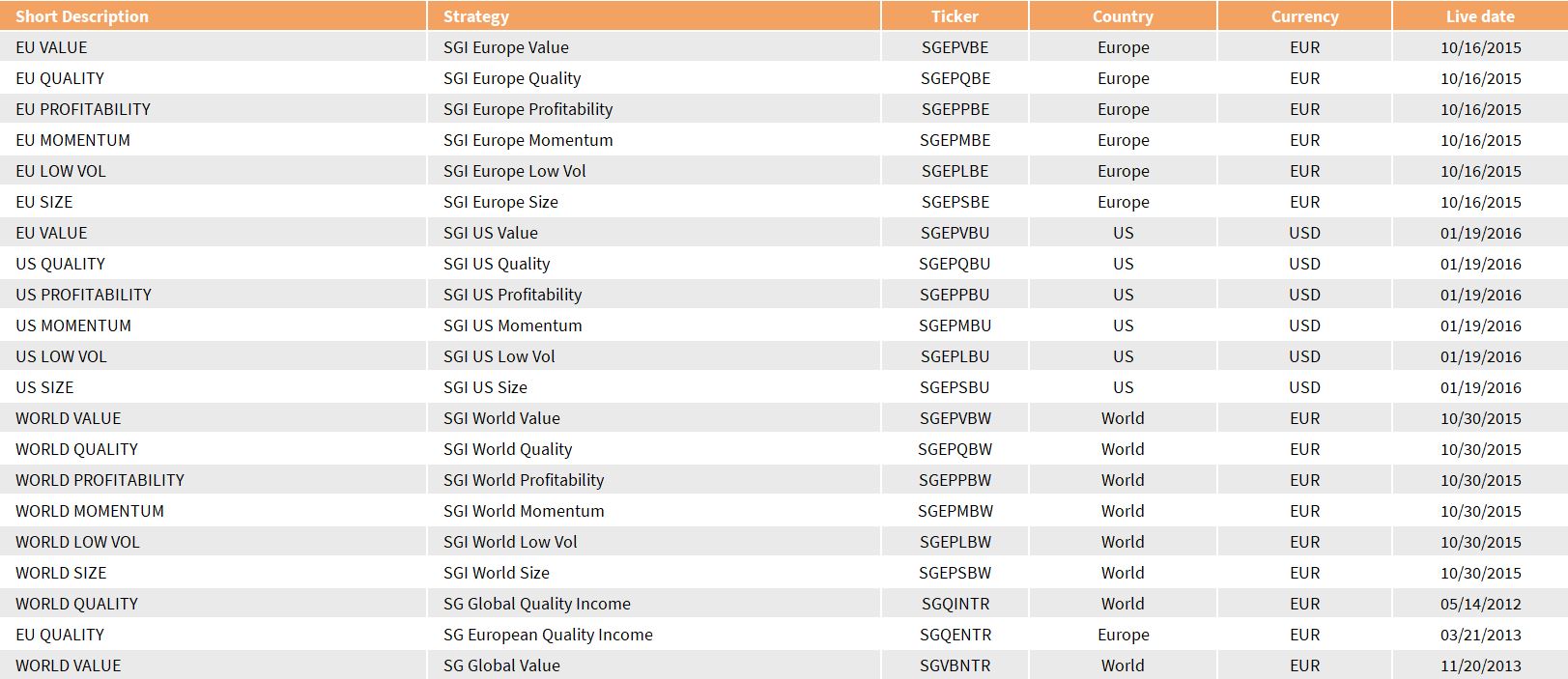

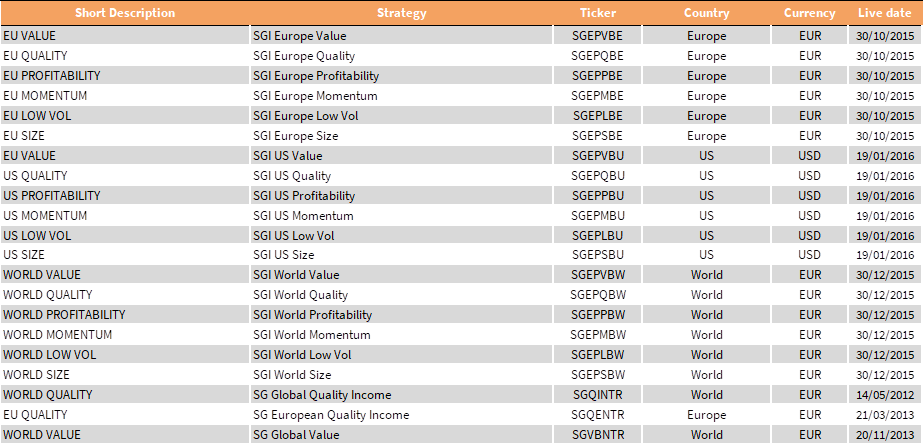

FACTORS

Investment approach using specific drivers of returns (Quality, value, Momentum…)

X

Rationale

Value strategies essentially consist of buying undervalued stocks and selling expensive ones, using some form of fundamental valuation metric.

The SG Value Indices aim to get exposure to undervalued stocks embedded in the Equity market (STOXX 600, S&P 500 or MSCI World).

The Indices provides exposure to a basket of cheap stocks extracted from each respective universe based on 5 value criteria according to a systematic methodology. The stocks are equally weighted.

Note, Certificate, Swap & ETF (, AuM : 20.14 Mn€)

SOLUTION

WRAPPER AVAILABLE

Value

Quality

Rationale

The main intuition behind quality investing is that counter to financial theory and efficient market hypothesis, investors are not compensated for the higher risk they take when investing in low quality stocks. Quality stocks tend to provide better capital protection in downturns.

The SG Quality Indices aim to get exposure to high quality stocks embedded in the Equity market (STOXX 600, S&P 500 or MSCI World).

The Indices provides exposure to a basket of quality stocks extracted from each respective universe based on profitability, leverage, liquidity, strong balance sheet criteria according to a systematic methodology. The stocks are equally weighted.

Ticker: EU : , US: , World:

Note, Certificate, Swap & ETF (, AuM : 1.16 Bn€)

SOLUTION

WRAPPER AVAILABLE

The value premium is probably the least disputed of all equity risk premia. However, harnessing this is not as easy as one might think, typically during periods of economic stress.

Ticker: EU : , US: , World:

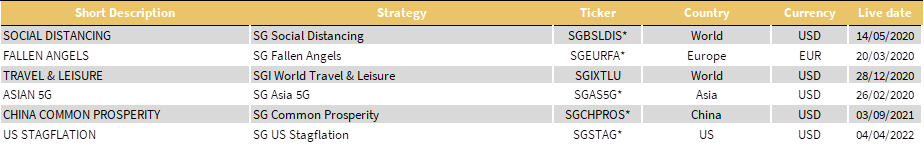

CURRENT AFFAIRS

Benefit from tactical themes

X

Rationale

Social Distancing

WORLD TRAVEL AND LEISURE BASKET

*The strategy referred to herein remains subject to approval by Société Générale’s internal committee. The strategy may be amended from time to time (economic terms and conditions or any other elements as the case may be) and should be considered as final only after the formal validation by the internal committee.

The COVID19 epidemic has triggered the biggest social distancing experiment in history.

Basket of 58 stocks (from a world developed universe) exposed to social distancing from 4 main themes: work mobility, study from home, online retail and delivery, play from home.

Click for more info

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Lockdown and restrictions have created permanent changes to the way individuals work, play, learn & shop. Such trend are likely to outlast the pandemic.

Selection made by the SG Equity Strategy Research team.

Ticker: *

Rationale

The Index aims to select stocks from travel and leisure sectors which have suffered during the pandemic crisis and have not yet returned to their pre-crisis levels. The Index is favourably positioned to benefit from the current environment driven by the improving outlook and the recovery of those stocks.

The strategy selects 60 stocks from a global universe under constraints:

Sectors diversification: Booking, Entertainment and live events, Airlines and airport services, Cruises and casinos, Hotels and resorts

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Ticker:

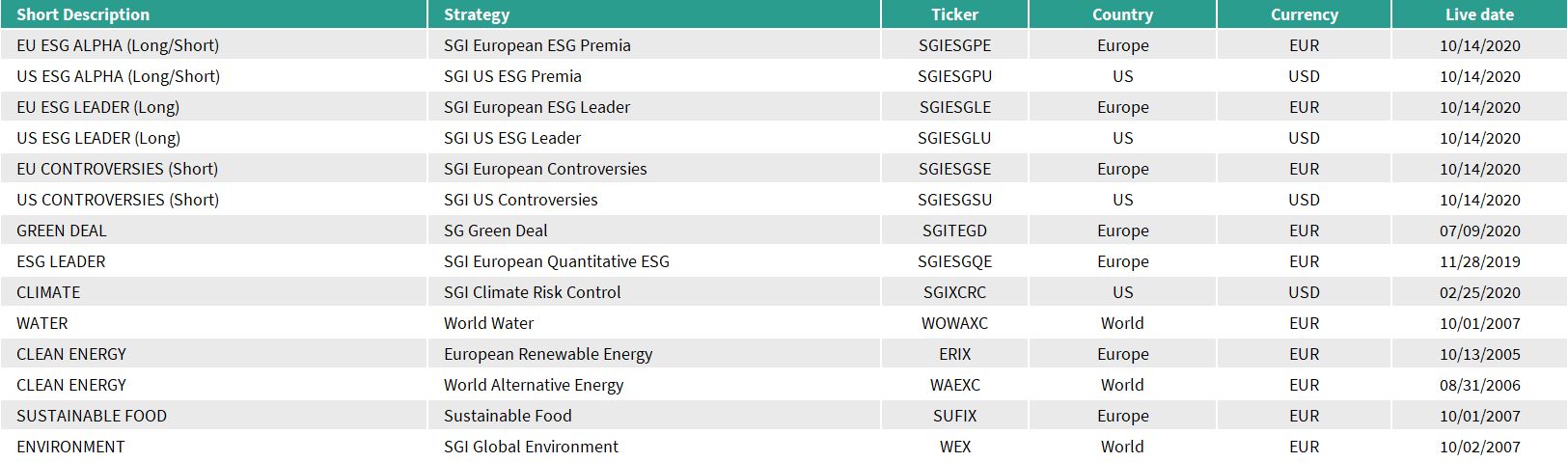

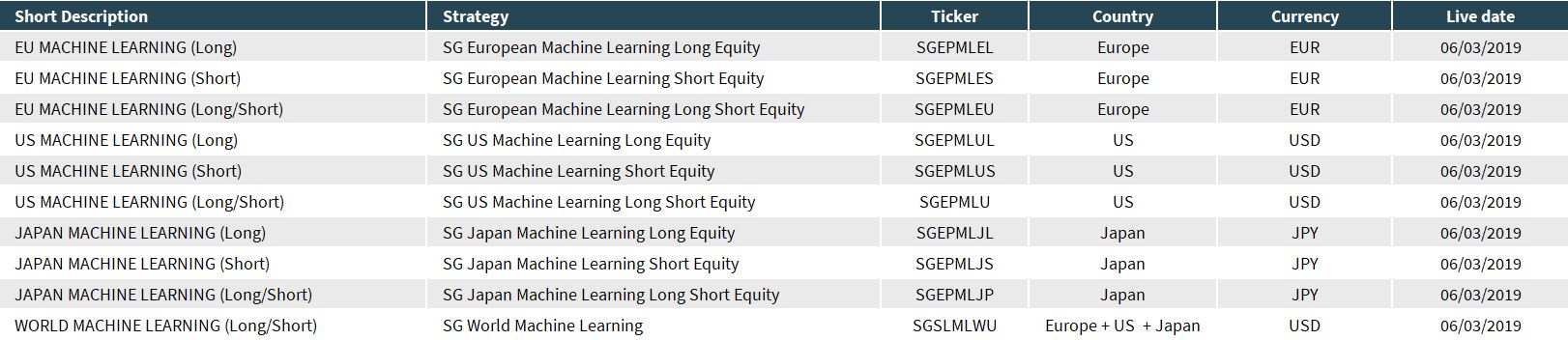

ESG

Address your environmental, social and governance priorities

X

Rationale

Investors’ appetite for ESG funds is more than a temporary boom in interest. In fact, since 2016, ESG funds have seen superior net inflows compared with all funds. Selecting ESG stocks could have a strong potential.

The SGI European () and US ESG leaders () Indices are long-only indices designed to select the best-in-class ESG-rated stocks based on the data provided by Sustainalytics - a global Leader in ESG ratings & Research.

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

EUROPEAN AND US ESG LEADERS

SGI European Quantitative ESG

Rationale

The Sustainable investing has seen unprecedented growth over the past few years

The SGI European Quantitative ESG Index aims to outperform its benchmark based on the strategy that excludes companies involved in sectors viewed as controversial by responsible investors, and those that breach the UN Global Compact, then applies a stringent selection of stocks in the top quintile in terms of ESG Score, as assessed by Sustainalytics; eventually, the strategy weights the selection using a Minimum Variance methodology.

*The strategy referred to herein remains subject to approval by Société Générale’s internal committee. The strategy may be amended from time to time (economic terms and conditions or any other elements as the case may be) and should be considered as final only after the formal validation by the internal committee.

Selection made by the SG Equity Strategy Research team.

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Click for more info on the Index

This significant growth was spurred by the increasing demand from asset owners and asset managers for investments generating positive social or environmental outcomes alongside higher long-term risk adjusted returns

ARTIFICIAL INTELLIGENCE

The next economic revolution

X

Machine learning on a world universe*

Rationale

Predicting how the stock market will perform and identifying the trending Equity Factors can turn out being a risky undertaking.

Global long/short strategy () based on a 1-month outperformers forecast on a US (), European () and Japan () universe. Leveraging on a ML algorithm developed by Microsoft, the SG Quantitative Research team developed a comprehensive model taking as an input 80 common equity factors.

Note, Certificate, Swap

SOLUTION

WRAPPER AVAILABLE

Using factual and unbiased features like the latest financial communication of an organization (i.e. their quarterly revenue results, etc.), Machine Learning techniques have the potential to unearth patterns and insights we couldn’t identify before, and ML models can be used to make accurate predictions to identify the incoming outperformers.

Discover more strategies on this theme

MARKET SEGMENT

Discover more strategies on this theme

Discover more strategies on this theme

Discover more strategies on this theme

Discover more strategies on this theme

Discover more strategies on this theme

By continuing to use our website, you are accepting our use of cookies. The cookies we use are "analytical" cookies. They allow us to recognise and count the number of visitors and to see how visitors move around the site when they are using it. To find out more or to change your cookie preferences, please refer to our cookies policy.

ACCEPT

By continuing to use our website, you are accepting our use of cookies. The cookies we use are "analytical" cookies. They allow us to recognise and count the number of visitors and to see how visitors move around the site when they are using it. To find out more or to change your cookie preferences, please refer to our cookies policy.

ACCEPT

The ESG Leaders Indices are designed as a stringent choice of basket, combining norm-based screening, sector-based and controversy-based exclusions, with Best-in Class ESG risk rating selection.

A hypothetical basket of stocks included in the Indices (around 100 stocks within each respective investment universe) is determined according to a systematic scoring methodology which aims to exclude certain stocks based on Environmental, Social and corporate Governance (ESG) criteria and select the best stocks according to the quality of their ESG rating.

While Europe is facing the third wave of the Covid-19 crisis, the vaccination campaign is significantly accelerating all around the world. While it generates hope for a long term economic recovery, restrictions designed to limit the virus’s spread continue to slow down some sectors convalescence.

Regions diversification: Europe, US , Asia

Maintaining a good overall liquidity

Rebalanced quarterly

To avoid stocks close to default, the strategy filters the stocks with a weak balance sheet using the Merton-Distance to default criteria.

The Rise of the Robots Index aims to get an exposure to market leading companies, whose business is positively impacted by the increasing development of artificial intelligence, automation and robotics.

Ticker:

Legal Information | Cookies Policy | Contact | Accesibility: not compliant

Legal Information | Cookies Policy | Contact | Accesibility: not compliant

IMPORTANT INFORMATION: CLICK HERE

ESG-tilted investments have further earned their place within investors' agendas thanks to regulatory developments

The quant allocation seeks to avoid concentration risk while respecting the liquidity constraints (max weight per stock). Hence the index allows for a similar risk/return profile as the benchmark while integrating a strict ESG selection, in line with our clients’ objectives and values to invest in responsible and sustainable solutions.